how to claim working from home in self assessment

Claiming working from home tax relief if you usually complete a self-assessment tax return. Your work Self Employment Short Form Details Allowable expenses Complete the box labelled Rent power insurance and other property costs Full Form.

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

This reduces your taxable income and the tax you have to pay.

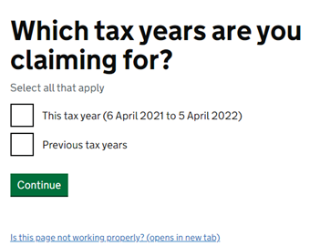

. To claim for the working from home tax relief. If employees were required to work from home during the 2020 to 2021 tax year but did not claim for the tax relief they have not missed. When completing the employment page there is a question asking if you wish to claim employment expenses.

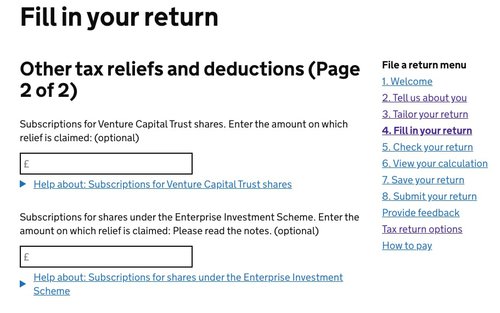

You do not pay tax through Self-Assessment this would mean that you claim tax relief through your tax return rather than. For the 2021-22 tax year you can make an immediate. BIM47820 - Specific deductions.

In this case you do not need to provide receipts. If you dont have one you can set one up along the way. To claim for tax relief for working from home employees can apply directly via GOVUK for free.

Below we consider different types of tax deductible employment expenses and explain. 1 Claim tax relief to the amount of 6 per week on coronavirus working from home expenses. To process claims most employees can use the HMRC working-from-home microservice though this doesnt apply if you do self-assessment via a form.

Use of home for business purposes I have now read both sections but neither. You need your Government Gateway ID if you dont have one you can create one during the process State the date you started. You can insert 312 in Box 20 of the employment pages of your self-assessment tax return to claim the standard relief for working from home all or some point during the 202021 tax year.

The HMRC online portal is incredibly simple to use and you can make your claim in a few minutes. You may be able to claim tax relief for some of the bills you have to pay because you have to work at home on a regular basis. To claim you will need to do this through your annual self-assessment tax return.

I assume box 20 in SA102 is the place but there will be others who can. You cannot claim tax relief if you choose to work from home If you go through the calculator it simply tells you to claim the expenses on your self assessment return. You will then come to an employment expenses page and should enter the expenses in the.

In addition you can ask HMRC to add the 312. How do I claim tax relief for working from home. Changing working patterns and working environments can change a.

Head over to the new HMRC tax relief microservice page and follow the instructions there. If you complete a self-assessment tax return then you wont be able to use the online portal to claim tax relief for working from home. How much you can claim.

The tax relief works by taking off the amount of the expense from your employment income. You have had to pay higher costs due to working from home. Those who do not submit a self-assessment tax return should simply make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on October 1 2020.

Posted 11 minutes ago by HMRC Admin 2 Hi You can find guidance for self employed working from home here. Youll also be asked if youre claiming any other work-related expenses. A link to the online portal can be found.

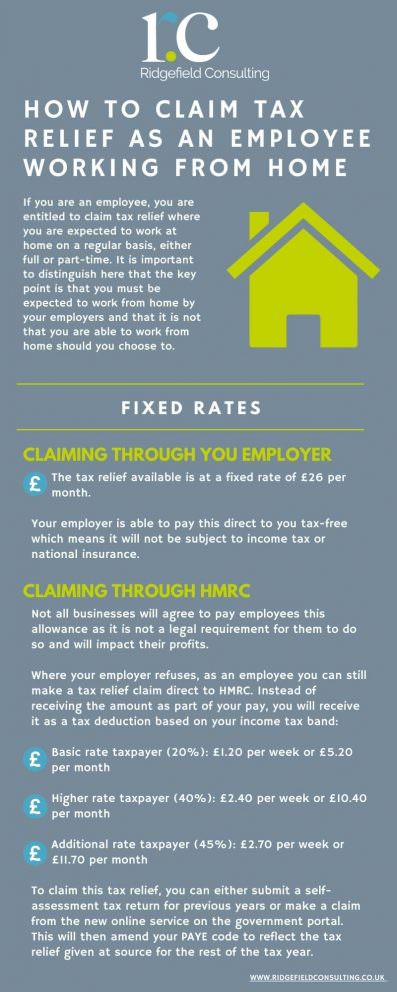

This is to help with increased household costs because of business use such as electricity gas phone. If you are an employee but have been forced to work from home because of the pandemic you can make a claim for some of the associated expenses. The first way you can claim is the simplest and this is by claiming a flat rate depending on the number of hours you work from home per month.

Your employer must NOT be paying for your working from home expenses. You must have been told to work from home by your employer. However when it comes to calculating how much you can claim there are two options.

Specific expenses Or if you are using the simplified method here. Through HMRC and the usual self-assessment. Martin Lewis founder of MoneySavingExpert this week confirmed with HMRC that it will consider claims from employees working at home due to coronavirus measures if their usual workplace is closed.

He says this can be worth 120 a week at 20 tax or 240. Working from home. You may have to make a claim in order to obtain this tax relief.

This will require you to have a Government Gateway ID. You can either claim tax relief on. If you are required to work from home by your employer or have a home working agreement in place with them you are entitled to claim a home working allowance.

This is why they are sometimes called tax deductible or allowable expenses. BIM75010 - Simplified expenses. Youll need to have your Government Gateway ID to hand if you dont have one yet you can set it up during this process.

Your work Self Employment Full Form Details Expenses breakdown 1 tick the top of the page to report your expenses in details and input the entry in the box labelled Rent rates. The amount you can claim at present is 6 a week. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs.

You will need to apply for the tax relief in your tax return instead. Thanks for the reply. Once their application has been approved the online portal will adjust their tax code for the 2021.

You cannot claim if you choose to work from home. Here you can claim tax relief on the up to 6 a week cost.

How Do I Tailor My Self Assessment Tax Return Youtube

How To Claim Vct Tax Relief A Step By Step Guide

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Different Ways To Claim Tax Relief When Working From Home

Money Savvy Teacher Tax Relief For Teachers Working From Home

Different Ways To Claim Tax Relief When Working From Home

Work From Home Tax Relief Scheme How It Works For 2021 22 This Is Money

0 Response to "how to claim working from home in self assessment"

Post a Comment