how to get agi from last year

Then you file your tax return using that. But with a little background knowledge all those tax terms can become a lot clearer.

Where Can I Find My Agi If I Filed With Jackson Hewitt Last Year

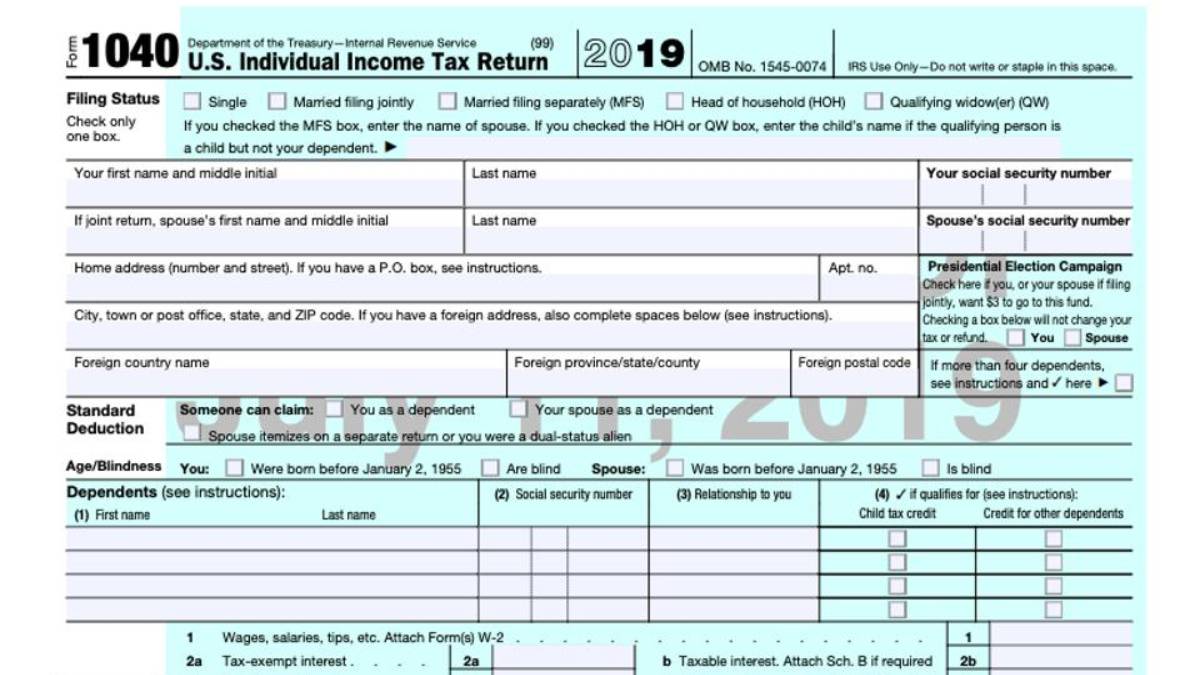

On your 2020 tax return your AGI is on line 11 of the Form 1040.

. How do I get my original AGI if I cannot locate my last years return. 16 What do I put for AGI if I didnt file last year. If you have the 2020 1040 return you filed with the IRS look on Line 11 for your AGI.

You can find your AGI on last years tax return. How to calculate AGI. Your AGI is on line 4.

The easiest way to get your previous year AGI for the IRS is to find your old tax return. Where do I find my previous year AGI. How to Locate Your Previous Year AGI If You Dont Have Access to Your Return.

You can locate your prior-year AGI on your 2020 return on Form 1040 Line 11. If youre filing your 2021 tax return and you filed a tax return for 2020 then you can find your prior year AGI by looking at your 2020 Form 1040 line 11. Households that welcomed a new member to the family last year could potentially see another 1400 stimulus check.

Select the Tax Return Transcript option and use only the Adjusted. Each year employers report your taxable income to you and to the IRS on a form known as a W-2. To retrieve your original AGI from your previous years tax return you may do one of the following.

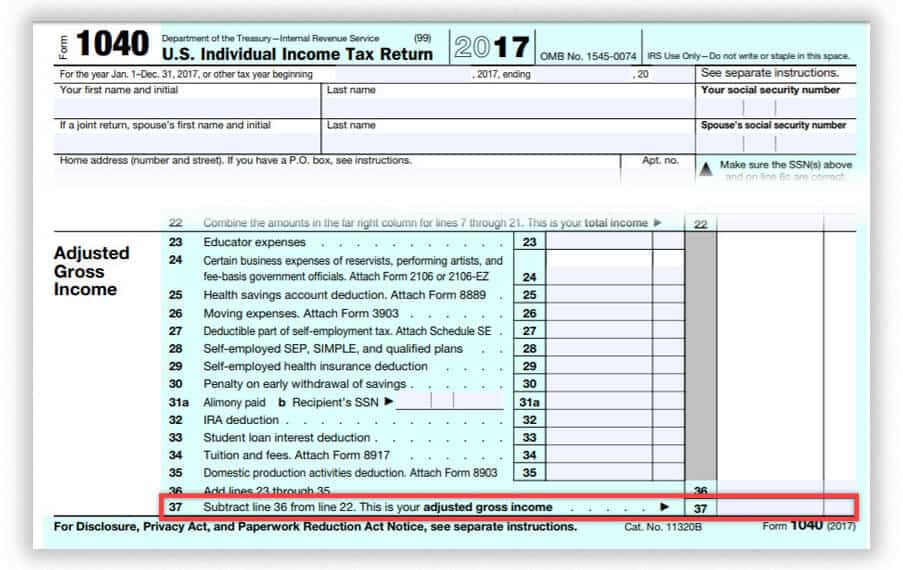

Tax season can feel like a jumble of alphabet soup with all the acronyms of letters and numbers being thrown around including AGI and W-2. For form 1040 youll find it on line 38. If you didnt file your taxes with TurboTax in 2019 the best place to get last years AGI is from the 1040 form you filed with the IRS.

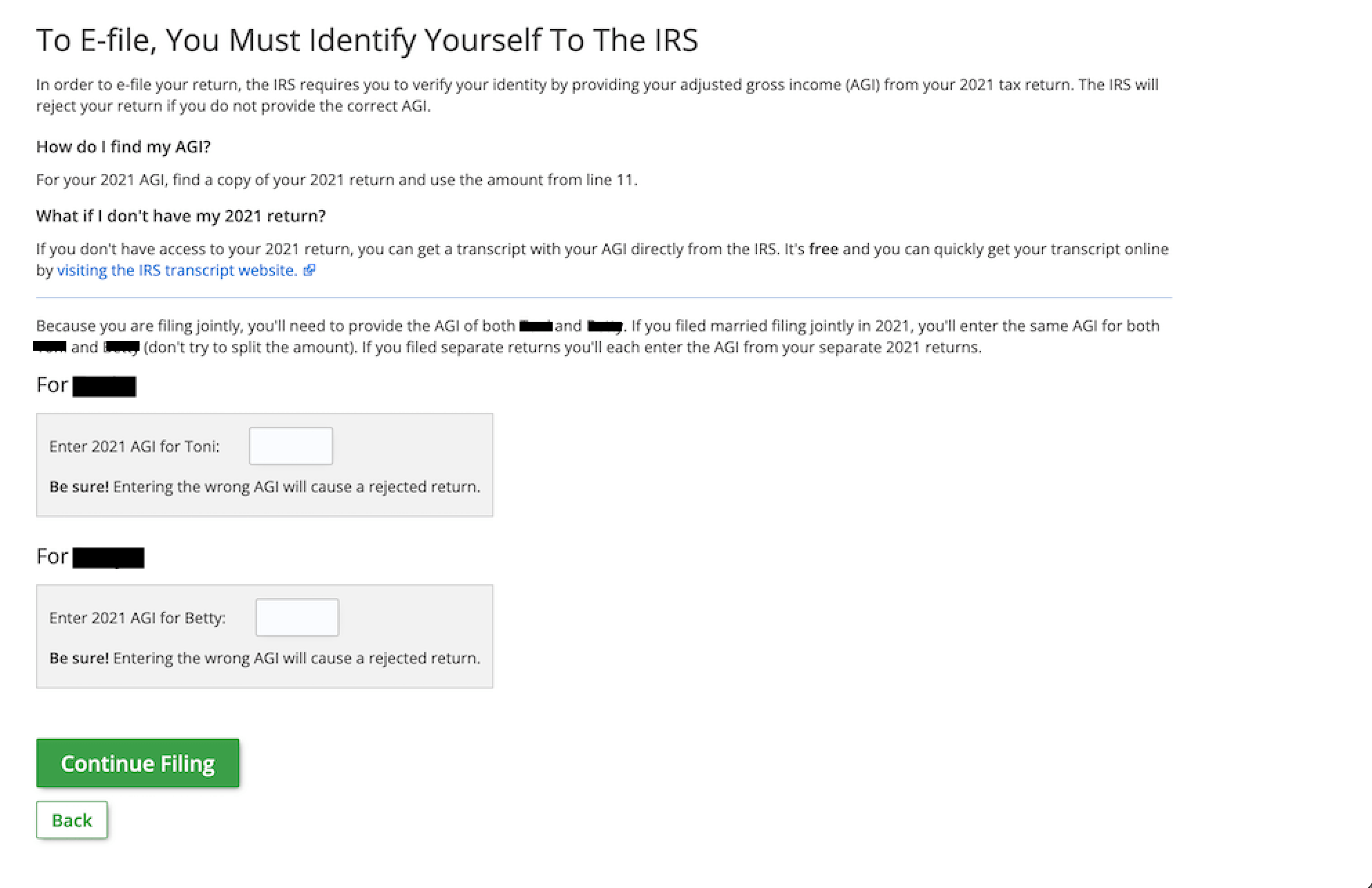

Enter your AGI in the box next to the Enter last years AGI line. How to find last years AGI. If you are filing a joint tax return enter the same AGI for you and your spouse if you or your spouse did not file or e-file a tax return last year enter 0 in the appropriate AGI field.

If your 2020 return hasnt been processed by the IRS yet you can try to enter 0 for your prior year AGI when e-filing your return. Add up all of these sources of income to find out the final annual income. With this video our main goal is to spread scientif.

You should always retain a copy of your tax return. The online version can be viewed immediately while the mailed transcript takes 5-10 days to receive. If you cant find your prior-year AGI you have a couple of options.

You must pass the IRS Secure Access identity verification process. 17 How do you find out what years I didnt file taxes. Use the IRS Get Transcript Online tool to immediately view your Prior Year AGI.

For 1040EZ you should find it on line four. If you filed a 1040NR look on Line 11. How do you get your AGI from last year.

The amount that you get is your adjusted gross income AGI. How do I get my AGI from last year on TurboTax. Youre AGI is on line 37.

To retrieve your original AGI from your previous years tax return or from the original return if you filed an amended return you may do one of the following. Complete Form 4506 Copy of Income tax Return. Or least the IRS would know that whoever e-filed this year had access to your last years return information.

13 How can I get my tax transcript online immediately. Youll need to request a copy of a return for 2020 from the IRS which you can do any of these ways. 10 How can I get my AGI from last year.

No matter the form youll be able to find your adjusted gross income easily. If you didnt file your taxes with TurboTax in 2018 the best place to get last years AGI is from the 1040 form you filed with the IRS. 12 Where is my AGI on my tax transcript.

This is the total amount you earned before any taxes or. Look on page 2 line 7. Your AGI is on line 21.

How can I get my agi from last year. Heres how to find your AGI. 11 What happens if I put 0 for my AGI.

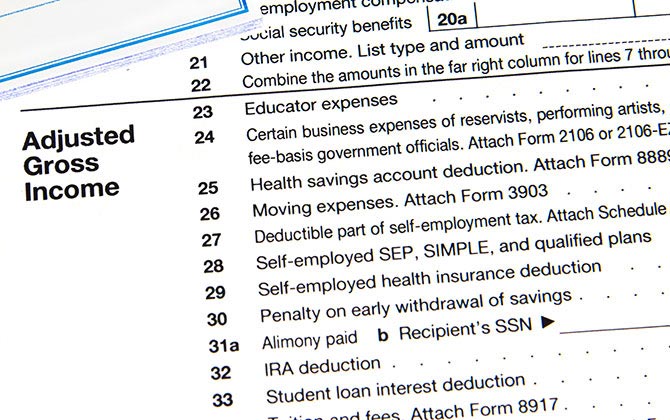

Now add certain payments known as above-the-line deductions or adjustments to income that you made in the last year. First locate your year-to-date earnings on your pay stub. Once the IRS has verified your identity they can give you your prior-year AGI over the phone.

Subtract above-the-line deductions from your final annual income. If you used TurboTax read this helpful FAQ on where to find last years AGI to sign this years tax return. Youll find your Adjusted Gross Income AGI on your original tax return not your amended tax return.

I tryed to call and no answer - Answered by a verified Tax Professional. Find AGI W2 How do you get your AGI from last year-----Our mission is informing people properly. Select View adjusted gross income AGI.

Sadly the AGI on my 2019 return didnt match the number I. If you dont have your 2020 return you can order a free digital transcript of your return directly from the IRS Get Transcript site. If you filed your 2018 taxes with TurboTax sign in and go down to Your tax returns documents.

15 Whats my AGI if I didnt file. There are several ways to find your prior-year AGI. Finally if you filed form 1040NR youll find your AGI on line 36.

Contact the IRS toll free at 1-800-829-1040. Select View adjusted gross income AGI. If you can remember your login information you will be able to look at last years tax return to get you AGIAlternatively you can call the IRS Telephone Assistance line at 1-800-829-1040.

14 Can I get my AGI online. If you used a paid preparer last year you might. How do you get your AGI from last year.

AGI below a certain threshold qualified for the full amount. If you used online tax software you can typically login and download a copy of your prior years 1040 tax return to find your AGI. Complete Form 4506-T Transcript of Electronic Filing at no cost.

If you filed a 1040NR itll be on line 35. 18 How can I see my previous tax returns. On form 1040A the AGI is located on line 21.

What Was Your Parents Adjusted Gross Income For 2019 Federal Student Aid

How To Get My Agi From My W2 Quora

Student Loans And Adjusted Gross Income Agi Tips For Low Payments

2020 Adjusted Gross Income Or Agi For The 2021 Tax Return

Where To Find Your Prior Year Agi Priortax

The Tax Filing Golden Ticket Know Your 2015 Agi Amount 1040 Com Blog

Student Loans And Adjusted Gross Income Agi Tips For Low Payments

Second Stimulus Check What Is My Agi And Where Can I Find It As Com

0 Response to "how to get agi from last year"

Post a Comment